With the intensification of the national policy of "trade-in old for new", the white goods industry will see explosive growth in 2025

Source:Pinxin Electronics

Date:2025.07.11

The policy is rising, and the industry is facing explosive growth.

In 2025, the white goods industry will usher in a once-in-a-decade policy dividend - the national "trade-in" subsidy will continue

to increase, and the industry will continue to rise with the recovery of overseas demand. According to the data, the scale of the

domestic white electricity market in 2024 alone has exceeded 722 billion yuan, a year-on-year increase of 4.2%, and more than

60% of the world's production capacity is concentrated in China. In the face of this round of opportunities, can the three giants

of Gree, Midea and Haier take advantage of the situation to break through? This article will deeply analyze industry trends and

core competitiveness of enterprises, and reveal the investment logic.

First, the release of policy dividends, the industry welcomes the golden development period

Domestic demand boost: Swap in to activate the stock market

In 2024, the Ministry of Commerce and 14 other departments will jointly launch the "old for new" policy, with the goal of increasing

the recycling of waste household appliances by 30% by 2027, directly driving the demand for replacement. According to the

calculations of China Securities Construction Investment, the policy overdraft effect is only in the middle and high single digits,

and there is still a large space for demand in 2025, and categories such as air conditioners and refrigerators will benefit significantly

Resilience of external demand: Overseas layout hedges tariff risks

Despite the tariff pressure in the European and American markets, Chinese white power companies have strengthened their ability

to resist risks through strategies such as overseas factory construction and technology export. In 2024, Midea's overseas revenue

will account for more than 40%, and Haier Smart Home will achieve double-digit growth in the European and American markets,

confirming the global competitiveness of "Made in China".

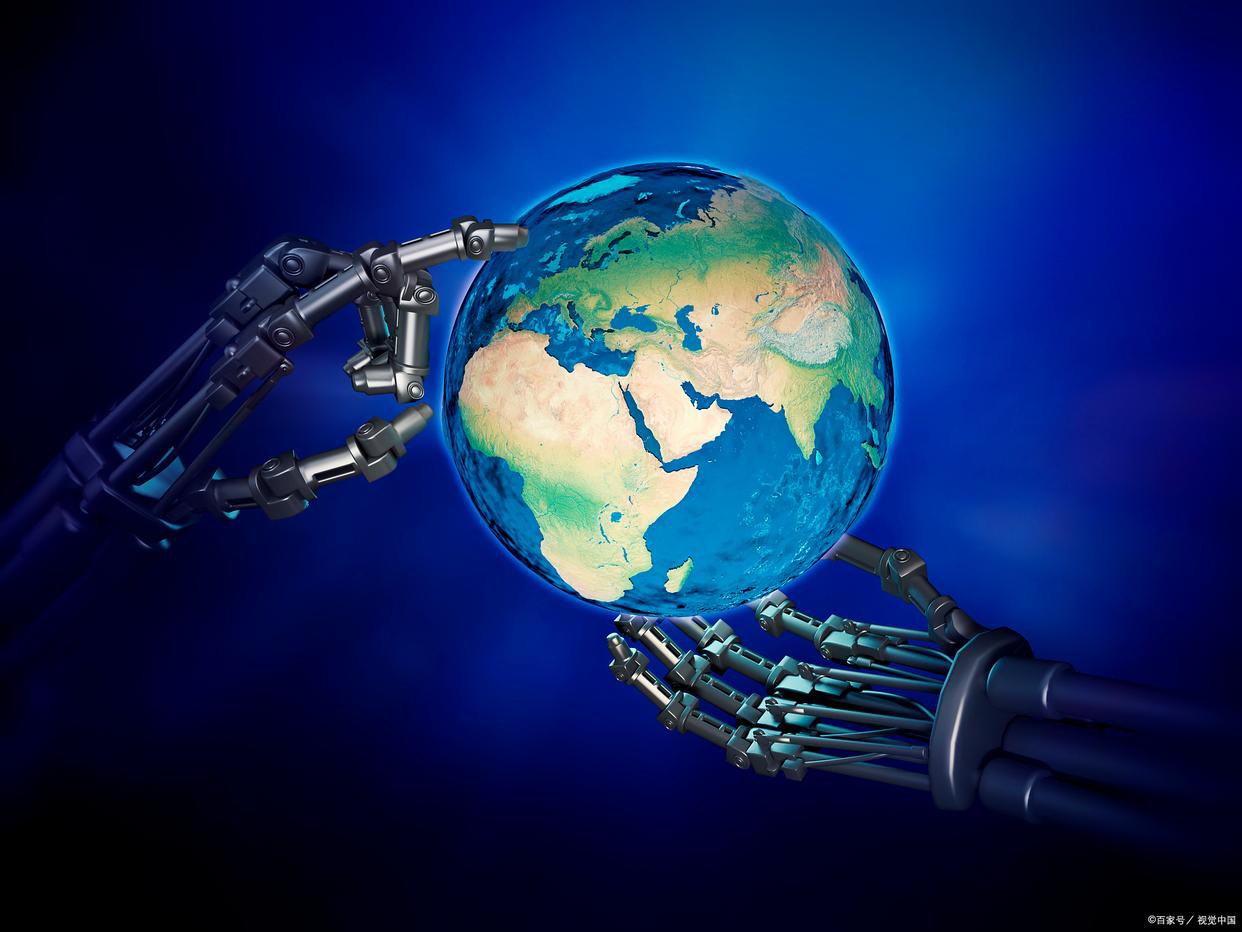

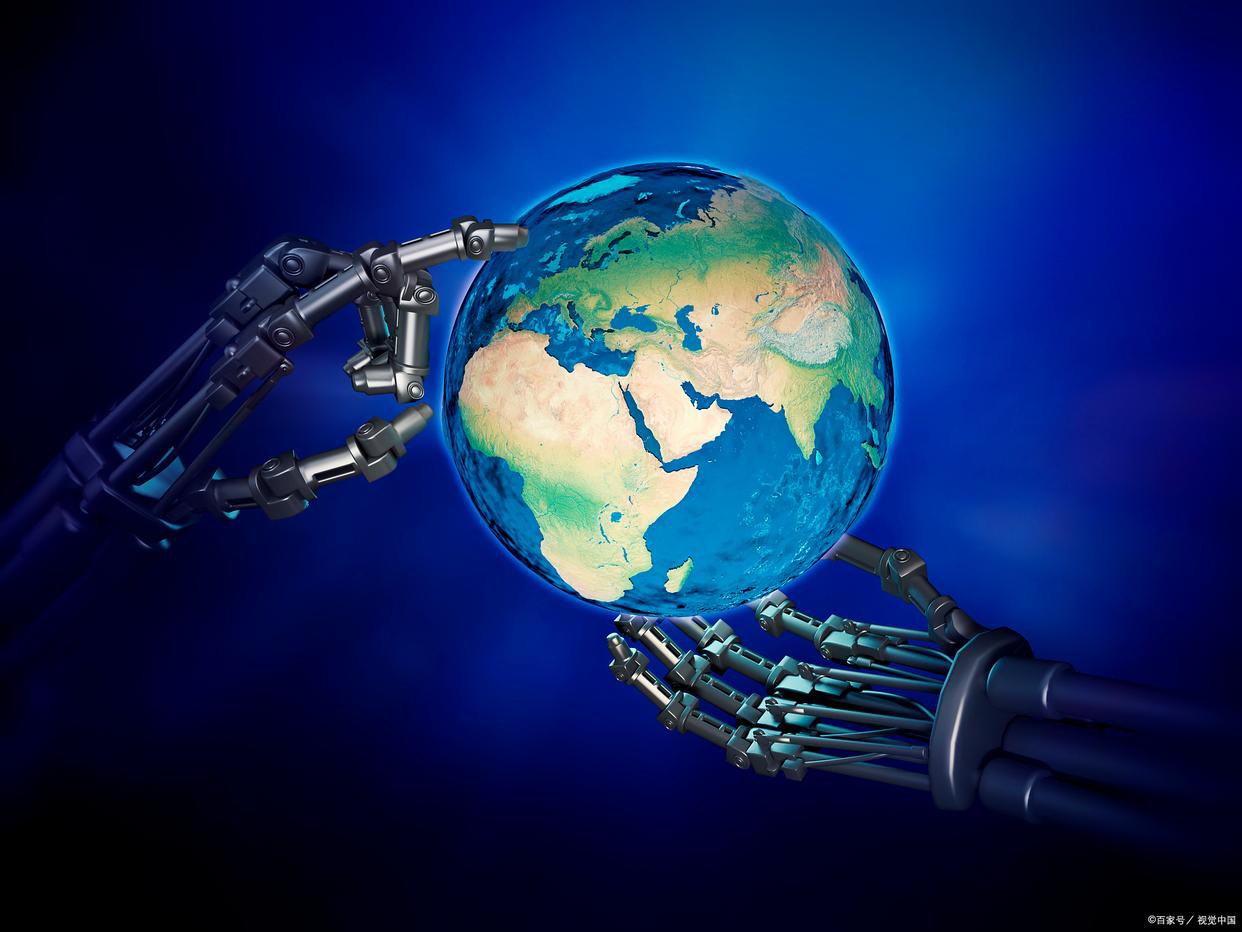

Technology upgrading: intelligent and green two-wheel drive

The Internet of Things and AI technology are deeply integrated into product design, and energy conservation and environmental

protection have become the core selling points. The energy-saving efficiency of the "optical air storage" system developed by Gree

Electric Appliances has increased by 40%, and the penetration rate of Midea Group's smart home appliances has exceeded 50%,

building a moat with technical barriers

II. The Big Three Lead the Charge, Technology Drives the Future

1. Gree Electric (000651): Technology Reigns Supreme, Unshakable Air Conditioning Leader

Core Strengths:

Operates 12 major R&D institutes with 100,000+ patents

2024 net profit: ¥21.96B (+9.3% YoY)

Industry-leading compressor technology (lowest cost structure, highest gross margin)

Strategic Expansion:

Aggressively developing solar-powered AC & energy storage

Building a "Zero-Carbon Smart Home" ecosystem

New energy revenue projected to exceed ¥10B by 2025

2. Midea Group (000333): Vertical Integration, Global Breakthrough

Business Depth:

Covers white goods, small appliances, robotics & automation

2024 revenue: ¥570B+ (nearly 50% profit from overseas)

GMCC compressors dominate 35%+ global market share

Innovation Highlights:

3. Haier Smart Home (600690): Scenario-Based Ecosystem, Premium Market Dominance

Differentiation Strategy:

Casarte luxury brand holds 40%+ market share

Q3 2024 revenue: ¥184.7B (+10% YoY)

"Three-Winged Bird" smart home solution boosts average order value by 50%

Globalization Mastery:

Overseas revenue now 52% of total

R&D centers in US/EU enhance local innovation

Localized operations mitigate trade friction risks

3. Investment logic: pay equal attention to stability and innovation

Valuation Edge of Industry Leaders

The white goods giants trade at P/E ratios below consumer sector averages (Gree 8.28x, Midea 12.87x), with high dividend yields

(Gree's payout ratio >70%) and earnings visibility making them safe-haven assets.

Emerging Players to Watch

Aucma (600336):

Cold chain technology leader

Top-tier commercial freezer market share

2024 stock price gained 6.73% against market trend

Policy tailwinds may drive valuation re-rating

Ecovacs (603486):

Cleaning appliance champion

Overseas sales growing >50% YoY

Smart product line becoming second growth engine

Risk Factors

• Commodity price volatility (copper/steel >30% of costs)

• Overseas policy risks (e.g., EU carbon tariffs)

• Intensifying price competition

Conclusion: Sustained Boom, Stronger Get Stronger

In 2025, dual drivers of policy and technology are transforming white goods from "low-valuation defensive plays" to "growth-value hybrid"

golden assets. Investors should focus on leaders' technological moats and global execution while monitoring niche innovators.

Data: Southern Wealth Network, CSC Securities, Industry Research Institute